Note: This content has been archived and may no longer be accurate or relevant

Some video links may have expired

The Shorewood City Council will begin working on the 2025 budget in late August. The department heads are now putting together numbers for their next year’s activities. This matters because the numbers put forth translate into the increase to your city portion of property taxes in 2025. Discussions will be held at public work sessions and council meetings. Follow the agenda schedules here.

Key budget information from 2020-2024.

Ex 2

Ex 2

Note: A fourth class city in Minnesota is a city with a population of >10,000, based on the most recent national census.

Note: A fourth class city in Minnesota is a city with a population of >10,000, based on the most recent national census.

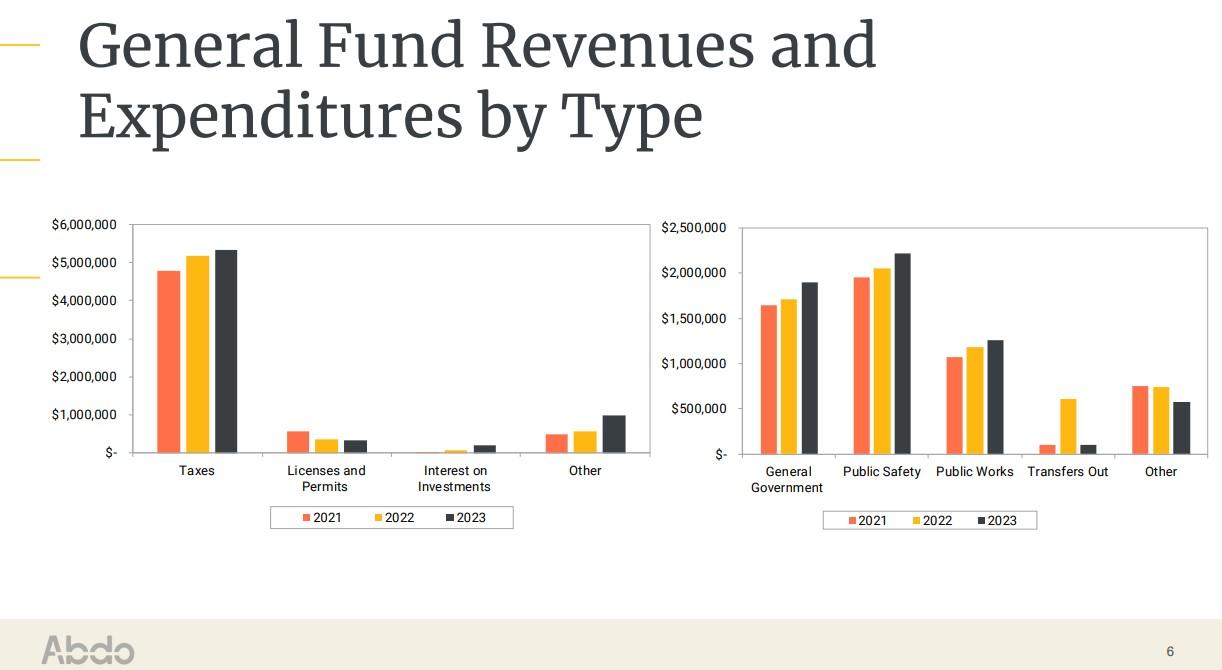

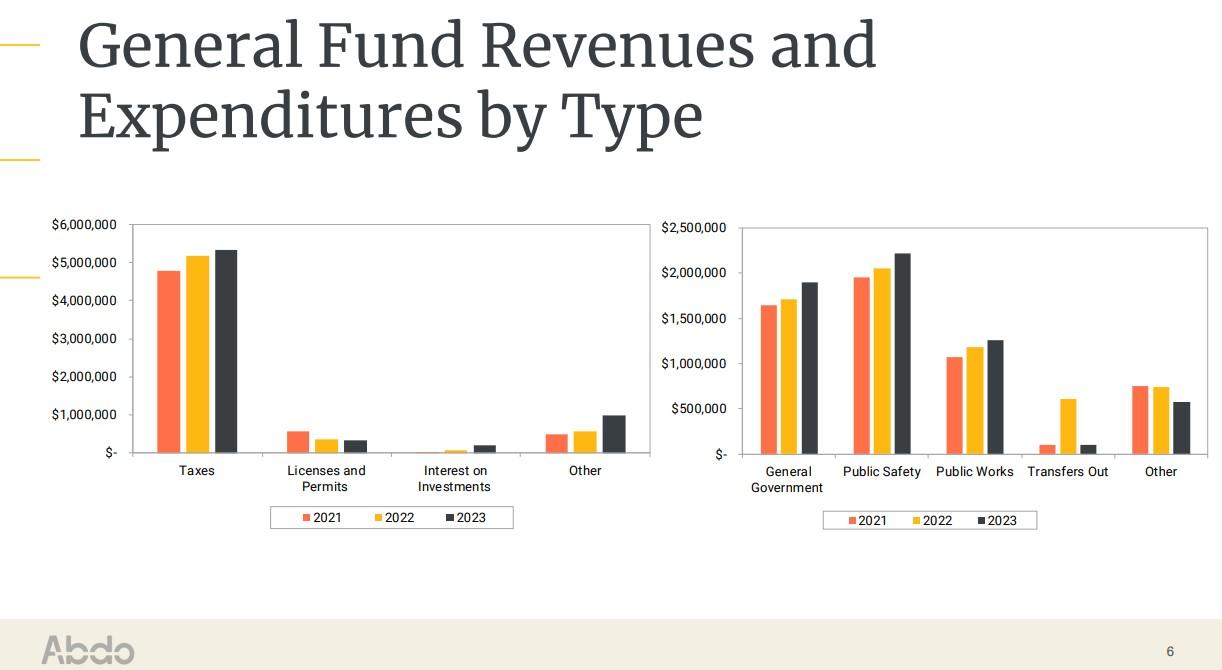

- From 2020-2024 City taxes have risen 21%, from the 2020 tax levy of $5,856,611 to 2024 tax levy of $7,115,274: a $1.25 million dollar increase in spending over 4 years. Taxes increased 2%, 3.5%, 5.5% and 9.3% over the same 4 years, with compounding, this totals 21%.

- The City has about $17,000,000 in cash in the bank (see Ex. 1 below); down from $20,000,000 in 2023.

- The City also has about $26,000,000 in bonding and other debt. Debt has increased due to large roadway projects and installation of city water without assessments. Mid-year debt numbers for 2024 are pending.

- The City budget in 2024 is about $7.1 million, with approximately 2,926 tax paying households. This trends high among Class 4 cities in Minnesota. See Ex. 2 below.

- 40% of the spending goes to public safety which is proposing a 9+% increase for 2025; General Government at 31%; Streets 20%; and Parks & Recreation at 9%.

- Land area: 5 square miles

- April 2020 population 7779

- 2926 households; median income $163,525 (2022)

- 93.9% of homes are owner occupied

- Median home value: $643,300

- Median age: 48

Ex 2

Ex 2

Note: A fourth class city in Minnesota is a city with a population of >10,000, based on the most recent national census.

Note: A fourth class city in Minnesota is a city with a population of >10,000, based on the most recent national census. Was this post useful?

Average rating 5 / 5. Vote count: 3

No votes so far! Be the first to rate this post.